Image: But can your social welfare spending buy this?!?!? (Northern lights over Saurbaer, Iceland / flickr user benhusmann)

I'm revisiting this 2014 post for two reasons. First--and most importantly--I did not realize when I first wrote it how important it was, so I outlined general trends and was not super careful about my analysis. My aim was to point out the hypocrisy of crying foul at the high tax rates of the social democracies even though a typical American is far worse off due to the high cost of private social welfare services. 40% taxes may seem high, but a median income American family can expect to spend over 60% of their income on federal (income plus payroll) taxes, employer-sponsored health insurance, and recommended savings for retirement alone--and this doesn't even include student loans payments (an additional 11% of income on an income-based repayment plan), day care services (up to 30% of income depending on the state), or other common social welfare costs. You don't need super careful analysis to make this point.

Second, some OECD links I used are now broken and so it's no longer clear where the data are coming from.

I'm keeping the original post up because it has some research which I don't need to repeat. But here, I'm going to be less sloppy on my analysis of labor costs and social welfare contributions.

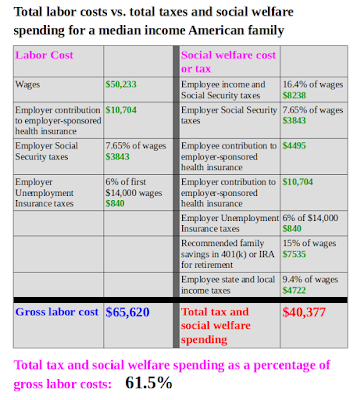

You can read this page alone and consult the original post for links that didn't make it into this post. Before beginning, recall that median income in the United States is pretty similar to the social democracies. Here is the revised table for median income households (click for unobscured image):

The blue percentages at the top of the table are expressed as a percentage of gross labor costs. For the American side, this means:

At first, it might seem reasonable to consider at what a typical family earns in income, then consider what percentage of that income they pay in taxes and for social welfare. But this is misleading, for two major reasons. I call this the "sticker price" of the social welfare state--the cost of the social welfare state that a typical individual or family sees, but not the cost that they actually pay.

The first reason why the sticker price is misleading is because it comes nowhere near the total cost of the welfare state for this family. The sticker price ignores many costs that support this family's social welfare benefits and services: the cost of employer contributions to Social Security, Medicare, and employer-sponsored health insurance, for example. Since these are costs that support the social welfare needs of this family, it makes no sense to ignore them.

Second, it simply makes no sense to think of individual labor costs as somehow different from each other. It makes no difference to an employer--whether American or Scandinavian--if a dollar is spent on cash wages, mandatory social security contributions, or fringe benefits; to an employer, a dollar spent on labor costs is a dollar spent on labor costs, no matter the final destination of that dollar. Indeed, in the social democracies, 90% of social security tax burden falls on workers; in other words, for every dollar an employer is forced to contribute to social security programs, a worker's wage falls 90 cents. Thus--on paper--employers pay 100% of the employer contribution to social security, but in reality, employees pay for nearly all of those contributions because their wages would be higher if the employer's social security taxes did not exist. And in the United States, a similar phenomenon occurs with employer-sponsored health insurance: employees accept lower wages at jobs that offer health insurance. Clearly, looking at one form of labor costs (cash wages) while ignoring all the others makes no sense since the line between wages, benefits, and mandatory employer social security contributions is blurred, to say the least.

In sum, it makes no sense to point to the sticker price as being a complete accounting of the social welfare costs of a typical family; it ignores too many costs of the social welfare state and ignores several forms of labor costs.

Thus, the only way to fairly estimate the total cost of the welfare state is to sum every component of welfare spending and express it as a percentage of every dollar spent on labor costs--and so I've done this for both the American and social democratic columns (the blue percentages at the top of the first table). This is captured for the American side in the immediately preceding table (the social democratic side is covered below), which is a complete accounting of the cost of the welfare state to a median income American family. The left column is every dollar that this family's employers spend on them: this includes wages, benefits, and mandatory contributions to Social Security. On the right is every dollar that goes to taxes or social welfare: all taxes and social security contributions paid by both employer and employee on wages or labor, and all money spent on social welfare benefits paid by both employer and employee (discussed in greater detail below). Obviously, some items are in both columns--for example, employer contributions to health insurance and employer contributions to Social Security are both labor costs to the employer and are social welfare costs. This table is the total cost of the welfare state for this median-income individual family: all taxes, social security contributions, and spending on private social welfare benefits as a percentage of every dollar an employer must spend to employ this family.

Here is a table of the cost of other common social welfare benefits and services, alongside their out-of-pocket cost in the American social welfare system--in dollars, as a percentage of income for a median income family, and as a percentage of gross labor costs for a median income family:

There is a range for child care because the cost of high quality child care services varies wildly by state. In nearly all states, however, annual child care costs exceed the cost of tuition at a public university.

The above three tables is this blog post. Before proceeding, please return to the three above tables. Clearly, the American social welfare system is a phenomenally bad deal for a typical family compared to the social democratic model.

Here's the outline for the rest of this post:

- As bad as the American side looks in these tables, it's actually worse than these basic numbers suggest. This is because the American side forces individual households to bear enormous risks in health care, retirement, and long term care. Also, the social welfare services available to a median income American family are of far lower quality than those same social welfare services available to a median income family in the social democracies. If we only look at the raw numbers, we lose sight of enormous financial risk and poor service quality of the American social welfare system.

- The research or calculations behind each cell of all three of the above tables.

The horrors of the American long term care system

Long term care refers to health care equipment or services for patients who are grievously injured or very, very sick. These patients will never get better; they will be sick or badly injured until they die, and they will likely die from their injury or illness.

For example, if you are hospitalized for a kidney stone and your doctor puts in a catheter to help you urinate, that catheter is "health care"--because you are in the hospital for an acute condition. But if you are so grievously injured in a car accident that you can no longer urinate without a catheter and have to use one for the rest of your life (perhaps you are even so or injured that you cannot replace your own catheters yourself and a nurse must come into your home every day to do this for you), those catheters are no longer "health care" but "long term care." Long term care often means a nursing home, but increasingly long term care services are being delivered in a person's home (this is a very positive development; nobody wants to leave home and live in a nursing home).

People who need long term care are extremely unfortunate--they had a serious accident or a severe heart attack, stroke, dementia, or some other very serious medical condition. They are so seriously impaired by their condition that they are no longer able to care for themselves. One might think that the American long term care system would treat individuals and families struck by such a catastrophe with compassion. One would be very, very wrong. For, only Medicaid pays for long term care services. But to become eligible for Medicaid--even if you would die without long term care--you must meet strict income and asset limits.

This is how the asset limits work: If you have more than $2000 in savings or assets (such as cars or other valuables), you are ineligible for Medicaid, even if you are grievously injured and cannot survive without long term care services. In other words, your family must spend every dollar they have on long term care down to $2000--and this includes the obvious things like checking and savings accounts, but also 401(k)'s and IRA's. Then, everyone in your household must sell everything they own of value and spend the proceeds on long term care. When you only have $2000 worth of stuff or money, only then can you apply for Medicaid. Your family can never have more than $2000 in cash or valuables or you will become ineligible for Medicaid--so you will not be able to own a car and your children can never have any college savings--because that would be owning more than $2000 in assets. Your family will have to liquidate all savings, even if they are in a 401(k) or IRA (and pay the early withdrawal tax penalties), and spend the proceeds on long term care. Your family can never have retirement savings--not until you die.

This is how the income limits work: If your family earns too much money in a year to qualify for Medicaid, you and the working members of your family must reduce your hours until you earn so little money that you do qualify for Medicaid (there are exceptions in a handful of states in certain circumstances). In most states, the income eligibility cuts off at 133% of the poverty line (for a family of 4, that's about $32,000 per year), but in some red states, it's closer to 10%. You would never be able to send your child to preschool, for example, because you will never have enough income to afford it--and a friend or relative in a different household couldn't pay for her preschool because that would be Medicaid fraud. "Luxuries" like preschool are unlikely to be a major concern for you family in this situation; more likely--living in poverty--you'll be worried about issues of food security. If you ran out of food and didn't have enough money to go to the grocery store, it would technically be Medicaid fraud for a family member to drop off some groceries for you--that is how insane our long term care system is.

So if you ever need long term care services to stay alive, your family will have to give up everything and live in poverty until you die. Perhaps you don't realize it, but you and everyone in your household is one car accident away financial ruin. Sometimes very young people are struck down by rare, debilitating diseases--you and your family are one medical condition away from destitution. An accident or severe illness is tragedy enough, but in the American long term care system, that tragedy will compound as your family will have to destroy their lives to keep you alive.

This sort of barbarism doesn't occur in the social democracies. In the social democracies, if someone needs long term care services, they get long term care services. Families who suffer the tragedy of a grievous injury to a loved one don't need to destroy their lives to keep their family member alive, as in the American system. Clearly, the social democratic long term care system is far better for individuals and families.

Out-of-pocket health care spending

The above tables do not include American out-of-pocket health care costs. A median income American family should expect to spend 61.5% of their gross labor costs on social welfare--but this only includes health insurance premiums, and not out-of-pocket spending on health care, whether deductibles, coinsurance, copays, or medical services not covered by insurance. There isn't good data on Americans' typical out-of-pocket expenses on health care in a year, so let's focus instead on the risk inherent in the system.

Thanks to Obamacare, health insurance deductibles and other cost sharing mechanisms are limited to $13,700 per year for a family. This is very good news, because prior to 2014, there were no out-of-pocket limits. The bad news is that Obamacare's cost-sharing limits are so enormous that they can easily bankrupt many American individuals and families (Figure 4). Indeed, $13,700 is over a quarter of the annual income of a median income family.

Think about what this means: if someone got cancer, their family would likely have to pay $13,700 per year for every calendar year in which their loved one had cancer--in addition to their health insurance premiums. Remember, the Obamacare cost-sharing limits apply to calendar years--meaning that if you get cancer in October 2016, you will likely have to pay the full $13,700 limit for 2016, then start all over with a new $13,700 limit for 2017 in January. Your family would have to pay both premiums and the $13,700 out-of-pocket limit for every calendar year you had cancer, until you died, went into remission, or your family was completely bankrupted by medical bills and became eligible for Medicaid.

Remember, prior to Obamacare, there were no cost-sharing limits.

For median income families without employer-sponsored health insurance, the situation is not much better. A non-poor median income household would be eligible to purchase health insurance from the Obamacare exchanges. For these plans, maximum household out of pocket spending is still quite high. For a family with Obamacare health exchange coverage, the maximum out-of-pocket spending is a whopping $10,400. Clearly, the American health insurance system forces American individuals and families to shoulder enormous risks.

By contrast, the single payer model for health insurance used widely around the world--from the social democracies to France to Canada to Taiwan--imposes little cost sharing on patients. The American Medicare program is a single payer system that imposes significant cost sharing on patients, so single payer does not necessarily mean low cost sharing--but in the social democracies, there is little cost sharing for health care. Again, the single payer model costs about half as much as the American health care model, yet ordinary households assume far more risk in the American model, and the American model delivers lower quality health care.

The enormous risks of individual retirement savings (IRA's and 401(k)'s)

I discuss the technical details of the retirement systems below, including differences in wage replacement rates. For the American side, I'm using estimations from the Center for Retirement Research at Boston College. It's worth nothing that there is a tremendous difference in risk assumed by retirees in the American system versus the social democratic system.

Americans are fortunate to have the Social Security program to rely on in retirement. The Social Security program is actually a social democratic program. As such, benefits are specified by law: the government has the legal obligation to pay retirees the benefits specified in the Social Security Act. You don't have to worry about your Social Security benefits; whatever happens, the government assumes the responsibility for providing those benefits to all American workers.

But as the Center for Retirement Research points out, it's not a terribly generous program, replacing approximately a third of retirees' working wages. Thus, in order to avoid a miserable retirement, you will have to save an awful lot of money for your retirement. These savings constitute the other half of the American retirement system, the individual retirement savings system: tax-preferred retirement savings vehicles like IRA's and 401(k)'s.

It's important to note that funding retirement is full of risks. For Social Security, every worker in the United States participates in the same Social Security program; thus, risk is spread across all society. However, you (and your spouse) are the only ones participating in your IRA or 401(k) plan--meaning all the risk of the system is borne by you (and your spouse) alone.

Based on the calculations of the center for Retirement Research, if a median income family saves 15% of their annual income in a 401(k) or IRA during their working years, they will have saved enough to ensure a comfortable retirement. But the estimates of the Center for Retirement Research rely on favorable forecasts of several factors that are out of any family's control. First, the Center for Retirement Research estimates assume the historical returns of the stock market continue. If returns are lower than historical averages, the working members of this family might live their retirement in poverty (because that lower rate of return compounds over their working years).

The Center for Retirement Research calculations also assume that this family owns their own home and that they sell it using a reverse mortgage (wherein a retirees get to live in their home until they die, at which time ownership transfers to the holder of the reverse mortgage; retirees receive the full cost of their home slowly in small payments over the course of their retirement). Obviously, this is a terrible retirement model--one that assumes retirees will sell their homes to finance their own retirements. But their calculations also assume that prices in the American housing market continue increasing at historical averages. And if housing prices don't increase at historical averages? Then this family could retire into poverty.

The Center for Retirement Research also assumes historical rates of inflation. But what if inflation suddenly rises and this family's retirement savings are diluted by rising prices? Again, they will retire into poverty.

Finally, the Center for Retirement Research bases all of their conclusions on averages. But averages can mask significant variation--especially because the individual retirement system is extremely risky. Any time there is such great risk, there are sure to be losers. Indeed, the risks of the 401(k) and IRA system in the United States are extraordinary: during the Great Recession, some workers' 401(k)'s lost a whopping half of their value; by 2015, six years into the recovery, some workers' 401(k)'s still had not recovered from the Great Recession.

Clearly, the American retirement system forces enormous risks on individuals and families: crossing your fingers and hoping for the best in high stock market returns, rising home prices, low inflation, and proper professional management of your 401(k) spells enormous risks for would-be retirees. Obviously, this is a terrible retirement system.

By contrast, the benefits of the American Social Security program and the pensions in the social democracies are guaranteed by law: no matter the performance of the stock market; no matter the performance of the housing market; and no matter inflation. A recession doesn't affect Social Security; a recession won't cut some peoples' Social Security benefits in half, then take six years to recover. The social democratic social welfare system does not expose workers to these immense risks. Unlike the individual retirement savings system, benefits are assured.

But isn't this a tremendous risk for the government to assume? Of course it is--and that's the point. Retirement security is a risky undertaking, but we're stronger when we work together. The risks inherent in any retirement system need to be spread across all society; each individual household should not have to confront these risks alone, because society can better shoulder these risks.

Yes, guaranteeing retirement security for everyone is a great risk for a country to take on, but a good country does not leave its elders to the wolves when inflation is too high or stock market returns don't meet historical averages--and that's exactly what the American retirement system does.

Clearly, a typical American family is far better off in the social democratic model. Let's double Social Security so families aren't forced to rely on the risks of the 401(k) model. The social democracies spend less per person on retirement security, and yet their retirement security is far better assured than in the more expensive American system.

Here is my take on the solvency of the American Social Security program.

Private American social welfare services are based on your ability to pay

The research on early childhood education is quite good. Children really do benefit from high quality early childhood education programs.

Let's say you and your spouse both have jobs. You stretch your budget to pay for a high quality day care for your daughter because you want her learning and having fun during the day. But suddenly you lose your job. Obviously, you can't afford day care anymore. In theory, you don't really need it because you'll be at home to watch your daughter during the daytime. But she will miss out on all the benefits of early childhood education.

Your daughter doesn't deserve to miss out on early childhood education because business slowed down for your employer and she had to eliminate your position. And in the social democratic model, all services are universal--meaning the children of unemployed workers still get to attend day care. Your daughter's early childhood education--and the other social welfare services your family would be eligible for in a social democracy--is worth society's investment.

Higher service quality

I have covered the issue of service quality elsewhere (the difference in quality of child care services is particularly stark). I noted in the original post:

[H]ealth care in the United States is of remarkably low quality ("...another 126,000 [American patients] die [each year] from their doctor's failure to observe evidence-based protocols for just four common conditions: hypertension, heart attacks, pneumonia, and colorectal cancer.").

Additional costs

This is what I wrote about the cost of additional social welfare benefits/services in the original post:

Interested in quantifying some of the costs not included on the American side? Full time child care costs for a four-year-old range from $4,312 to $12,355 depending on the state, for an additional 7.0% to 20.0% of median household income. For an infant, costs range from $4,863 to $16,430 depending on the state...What if you and your spouse went to college? College tuition is free in social democracies (don't be quick to assume that American universities are of higher quality). On an income-based repayment plan for a family making $50,000...where both parents have a typical amount of student loan debt, monthly payments would be $422...(For income based repayment plans for student loans, any remaining balance is forgiven after 25 years. Somewhat amusingly, this household wouldn't even be able to pay the full student loan balance by the time it's forgiven in 25 years.)

Leave benefits

I'll also blockquote my original explanation of leave benefits. Parental leave indicates a monthly cash benefit to stay home from work following the birth or adoption of a child; extended sick leave indicates a monthly cash benefit for those who are temporarily too sick to work (ie, following a major surgery); and family leave indicates a monthly cash benefit to stay home to care for a very sick or disabled relative who is unable to care for herself, but does not (yet) need long term care services:

Paid leave is probably not offered to a family where two wage earners earn $51,017 (both parents making in the neighborhood of $25,000 per year; what job paying that level offers extended paid leave?). In the United States, the Family Medical Leave Act covers extended leave. 40% of employees are not covered by FMLA and are entitled to no leave whatsoever. If you're lucky enough to be covered by FMLA, it's illegal for your employer to fire you if you take unpaid leave for 12 weeks (no matter how severe your medical condition is--social democracies offer several years paid leave if your medical condition warrants it), but that's it. Governments in social democracies pay people 75-85% of their salary (depending on duration) to stay home and care for an ailing relative, recover from a surgery, welcome a new child into their family, etc. This is available to anyone who finds themselves in a position where they need to take an extended leave of absence from their job. For comparison, social democracies range from 32 (Finland) to 47 (Sweden) weeks of paid parental leave. American FMLA allows 12 weeks unpaid parental leave, and 40% of American employees are not covered.

Clearly, the social democratic model is better for a typical family than the American social welfare system

Without doubt, for a typical American family, the American social welfare system is more expensive, offers fewer services, offers lower quality services, and forces them to shoulder extraordinary risks that are better borne by society. There can be no doubt that a most Americans would be better if we switched to a social democratic welfare system.

The rest of this post explains the technical details of each cell.

Consumption taxes

The social democracy side lists 12% consumption taxes. Both the United States and the social democracies use consumption taxes: the United States' consumption taxes are all state/local sales taxes (there are no federal sales taxes) and the social democracies' consumption taxes are known as Value Added Taxes (VAT). VAT are similar to sales taxes. For the state/local taxes cell for the United States, I'm using the estimates (see below) of Citizens for Tax Justice, and these estimates include consumption (sales) taxes. However, the OECD data I used to calculate the blue percentage for the social democracy side (40%) do not include VAT. I was unable to find estimates of the VAT tax burden as a percentage of income for the social democracies. However, I did find Eurostat estimates (see Table 12) of VAT rates as a percentage of household expenditure for Denmark (13.3%), Finland (11.0%), and Sweden (11.7%) for an average rate of 12%. However, these are ceiling estimates because they are expressed as a percentage of household expenditure, not household income. Remember, the table is expressed as a percentage of augmented gross labor costs (see below), which is significantly higher than household income. And households do not spend all of their income; any income that is saved is not subject to VAT.

Household augmented gross labor costs > household income > household expenditures

Thus, 12% is a large overestimation of what a typical household will pay in consumption taxes in a social democracy.

Replacement rates in the American and social democratic retirement systems

Compared to the 2014 post, I've switched retirement calculations for the American side to a better source: The Center for Retirement Research at Boston College estimates that a middle income household needs to save 15% of their income throughout their working years in order to attain 71% wage replacement in their retirement. The Center for Retirement Research estimates that a middle income family can secure a comfortable retirement with 71% wage replacement. (In their calculations, 71% wage replacement includes Social Security benefits).

As discussed above, that 71% wage replacement is not a guarantee; because individual would-be retirees assume so much risk with the 401(k) and IRA systems, that 71% is not assured and could be far, far lower. The social democratic model guarantees retirement security for its citizens and does not force them into relying on risky individual retirement savings vehicles.

To be very thorough, let's look at the wage replacement rates of pensions in the social democracies. The OECD ran simulations and came up with the following replacement rates (look to the value to the left of the red box for median income earners):

Replacement rates in Iceland (69.2%), Denmark (67.8%), and Sweden (64.4%) are comparable to the targets and calculations of the Center for Retirement Research. The average is 61.4% wage replacement, which is a little lower than the targets and calculations of the Center for Retirement Research. Since replacement rates are similar, we can consider this an apples-to-apples comparison. Obviously, we could design a social democratic retirement system with whatever replacement rates we wanted.

How I calculated the American column

This section contains more information on how I made the second table on this page, reproduced here:

My original post was very convoluted; I should have realized that such wide ranging data make more sense in a table. This is the table I should have made in 2014.

The cost of employer-sponsored health insurance--as well as average employer and employee contributions--are 2014 Kaiser Family Foundation estimates.

In the immediately preceding chart, the left column is every dollar that this family's employers spend on them: this includes wages, benefits, and mandatory 7.65% (6.2% for OASDI and 1.45% for Medicare) contributions to Social Security. These are the gross labor costs. On the right is every dollar that goes to taxes or social welfare: all taxes paid by both employer and employee on wages or labor, and all money spent on benefits paid by both employer and employee (employee federal taxes--which includes income and Social Security (payroll) taxes--are Citizens for Tax Justice estimates for the middle 20%). This is the total cost of the welfare state for this median-income individual family: all taxes, social security contributions, and spending on private social welfare benefits as a percentage of every dollar an employer must spend to employ this family.

In the original post, I did not include state income taxes--that row in the table is new here. For state income taxes, I'm using 2015 estimates from Citizens for Tax Justice for the middle 20% (apparently CTJ started doing these estimates after 2007 so I couldn't use 2007 data).

How I estimated the social democracy column

The OECD keeps really good data on this topic--though not for the United States. It will become clear below why I could not use OECD data for the United States and instead had to calculate it by hand (as outlined in the previous section).

Here's a roadmap:

- Calculate "sticker price." Most Americans are probably not aware that their employer must contribute to Social Security. When people think of their tax burdens, they usually think of taxes they pay (income and social security taxes) as a percentage of their cash income, rather than the complete picture as in the immediately preceding chart. I call this the "sticker price," and I think it's useful to compare the social welfare sticker price of the social democracies.

- Sticker price is a very incomplete measure, so we'll next add in employer tax burdens, similar to the immediately preceding table. To be completely honest, step 2 is really unnecessary but for the fact that the OECD published a bunch of beautiful graphs on this topic that contain a great deal of useful information, which I pasted in below.

- Finally, we'll get the complete apples-to-apples comparison we're looking for: all social welfare taxes and spending as a percentage of total labor costs. Step 2 did not include private contributions to social welfare. This really only makes a difference in Iceland, where pensions are private and therefore not included in the OECD data for step 2.

Following are a series of OECD graphs depicting the tax rates of various households, broken down by component. (Since the OECD keeps breaking their links, I've wised up and started blockquoting or pasting in images that a post relies on.) First, however, I'll explain what each component represents.

Most of these statistics are expressed as a percentage of total labor costs, because this captures the cost of the welfare system to an individual family most fully, as explained above. This is the same calculation as I did for the American side.

employer SSC as % of total labour costs - Mandatory employer social security contributions. As we saw above, in the United States, employers contribute to the Social Security program an amount equal to 7.65% of each employee's wages. While the social democracies have equivalent systems, social security tax rates vary greatly by country.

average local income tax as % of total labour costs - Average local income taxes a household must pay as a percentage of total labor costs.

family benefits as % of total labour costs - Cash benefits paid by the federal government to households. This does not refer to an employer's fringe benefits (eg, employer-sponsored health insurance, employer contribution to a 401(k), etc). This only refers to cash benefits paid to households by the federal government.

employee SSC as % of total labour costs - Mandatory employee social security contributions. In the United States, employees must contribute 7.65% of their wages to the Social Security program; while the social democracies use an equivalent system, the social security tax rates vary greatly by country.

average central income tax as % of total labour costs - Federal income taxes a household must pay as a percentage of their total labor costs.

The dashed line and solid line are our main concern here. The dashed line represents the total taxes paid by each household as a percentage of their income. The solid line represents the total taxes and social security contributions paid by the household and their employer as a percentage of total labor costs.

The x-axis indicates the percentage of national average wage for the household. A household at 100 at the x-axis, therefore, earns exactly the average wage of their country. A household at 50 earns 50% of the average wage of their country (for most countries, 50% median national income is the definition of the poverty line). We can assume that median wage occurs between 90 and 100% since the average wage is higher than the median wage.

I've left out Denmark because the dashed lines for their graphs are mysteriously missing. This appears to have been a mistake in the publication (because for there to be no dashed lines would mean that the Danes pay no income taxes).

In sum: following the dashed lines, a typical total tax rate in the social democracies for a median income family (100 on the x-axis)--federal income taxes plus local income taxes plus social security taxes clusters around 25 to 30% for the social democracies (the rate for single parents clusters lower, between 20 to 25%). And tax rates rise slowly as incomes increase (the graphs end at 250% median income, which would be about $125,000 per year in the United States), plateauing between 35-40%. Overall, it's fair to say that the majority of people in the social democracies belong to a household paying 25-35% taxes.

I'll call this "sticker price" because these are the taxes a family pays as a percentage of their cash income:

It's a very interesting figure, but--as discussed above--gross labor costs is a much more accurate estimation of the cost of the welfare state to a typical family.

Step 2

So, we'll look past the sticker price and up to the solid line, which counts all taxes and social security contributions as a percentage of total labor costs:

Unfortunately, the data for public social welfare costs do not include mandatory contributions to private social welfare programs. For example, the reason Iceland's public social welfare cost is so much lower than the rest of the social democracies is because pensions are actually private. Employees are required to contribute 4% and employers 8% of employee income to a private pension. This functions exactly like a social security tax on employees and employers, but because the pension is private--and not public--these contributions (even though they are mandatory) are not counted by the OECD's data because they are technically not social security contributions. The OECD calls these missing contributions non tax compulsory payments (NTCP).

Step 3

Fortunately, the OECD publishes data for public social welfare costs plus NTCP, but the data are not presented nearly as clearly. I could have skipped over step 2 entirely, but because since the graphs contained so much great information (and for such a wide range of income levels and different family types) I decided they were worth including. For the public social welfare cost plus NTCP, instead of nice graphs we get spartan charts with much less data. Here is my condensation of their excel sheets:

[Recall that Denmark's graph was missing above due to an error in the publication. Note that all rates for Denmark in this table are lower than average for this group]

The OECD explains these data as:

Average compulsory payment wedges (table 1 - updated 2015) measure the taxes and NTCPs that employees and employers have to pay net of benefits as a percentage of “augmented” total labour costs, i.e. gross wage earnings plus employer SSC and payroll taxes plus employer NTCPs.In other words, these data capture exactly the cost that an individual household pays for the welfare state. We've tallied up all of the labor costs of a worker: their wages plus their employer's mandatory (tax and non-tax) social welfare contributions. The OECD calls this the augmented total labor costs. And the table gives the percentages of compulsory payments (employer social security contributions, employee federal income taxes, employee local income taxes, employee social security taxes, employee non-tax compulsory payments, and employer non-tax compulsory payments) as a percentage of augmented total labor costs. I'm calling this total household cost of the welfare state. For clarity, I've condensed this into a table:

These are the data I'm using to estimate the percentage in the first table on the social democracy side (the blue "40%"). 40% is the approximate cost of the social democratic welfare state to an individual median income household: total household cost of the welfare state as a percentage of augmented gross labor costs. I decided to use the value of 40%; this is a good ceiling value overall. In the original post, I assumed a married couple with children; in the immediately preceding table, the rate for all five countries for married couples with children is a few points below 40%. For a richer family (at 167% median income), 40% is still a higher rate than a married couple with children will pay all five countries. 40% is a decent ceiling estimate for most of that table--except for single parents (who pay far less than 40%) and high income single individuals without children (who pay more than 40%).

Note that we can't use these data for the United States because employer-sponsored health insurance is not compulsory and thus doesn't count as a NTCP. That's why I had to calculate augmented gross labor costs by hand for the United States but could use OECD data for the social democracies.

Note also that--aside from Iceland--the percentages including NTCP are not terribly different (or in Finland, equal) compared to public social welfare cost percentages. This is because the social democracies do not use non-tax compulsory payments very often. Again, the exception is Iceland, which requires a 4% employee and 8% employer contribution to a private pension. I've adapted a different OECD graph to illustrate this point (note that this graph is for unmarried individuals without children; as discussed above, this group pays higher rates than everyone else in all five countries):

Again, the white bars represent what I'm calling the public social welfare cost, and the blue bars represent what I'm calling the total cost of the welfare state (which is the public social welfare cost with non-tax compulsory payments factored in). Aside from Iceland, the difference is tiny or zero for the social democracies. Sweden's difference is just 0.22%--a mandatory 0.22% employee contribution to the Church of Sweden's burial fund. And finally--because employer-sponsored health insurance is not a compulsory payment--the United States doesn't have any non-tax compulsory social welfare payments and the white/blue bars are equal.

* * *

That should explain every cell of the first two tables on this page. If I missed anything important, let me know in the comments.

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

BORROWERS APPLICATION DETAILS

1. Name Of Applicant in Full:……..

2. Telephone Numbers:……….

3. Address and Location:…….

4. Amount in request………..

5. Repayment Period:………..

6. Purpose Of Loan………….

7. country…………………

8. phone…………………..

9. occupation………………

10.age/sex…………………

11.Monthly Income…………..

12.Email……………..

Regards.

Managements

Email Kindly Contact: urgentloan22@gmail.com

What an incredible story in my life, I am Mrs Wilecia Berbana ,currently living in New York City, USA. I am a widow at the moment with three kids and i was stuck in a financial situation. Last two months i needed to refinance and pay my bills and some others serious debt. I was looking for a loan of $ 650,000.00 USD then I apply for a loan in one of the on-line loan company where i was scam about $3,800,00 usd in lending in the UK, but when I put the complain my good friend told me that the only place to get a loan on-line is CONSUMER LOAN FIRM the company is 100% guarantee that if I apply in a business loan I am to get the loan without any delay in the transaction, so i did, with a great fear in my heart not to loose money for the second time. My brothers and sister i want to let you know that there are still good people in the world we can trust and have faith on. With the advice of my friend in which I ask the company for a loan last week and to my greatest surprise i just got my loan yesterday. My hope and trust was all gone but now i new there are real loan firm we can trust. Am using this opportunity to inform you all that if you are in need of a loan, do not go else where so sick for a loan. i have found a real loan lender that can help you because he told me that the success of the societies is his pride i want you to sick for a loan in CONSUMER LOAN FIRM. Here are the company email: consumerloanfirm@gmail.com And i promise you that your life will never remain the same again, I will be waiting to hear your own testimony. Mrs Wilecia Berbana

ReplyDelete